FSC responds to concerns about Insurance Premium Financing

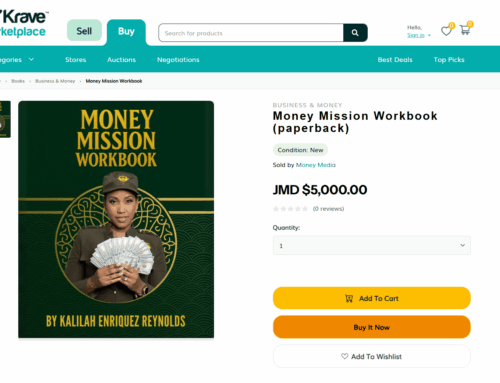

The Financial Services Commission (FSC) has responded to concerns raised in a recent episode of Taking Stock with Kalilah Reynolds. The FSC has also agreed to be a guest on next week’s episode, which will premiere at 8pm on Tuesday. See the full response in a letter copied below:

August 26, 2021

Mrs. Kalilah Reynolds

Chief Executive Officer/Executive Producer

Kalilah Reynolds Media Limited

Dear Mrs. Reynolds,

Reference is made to your recent episode of “Taking Stock” where certain statements were made in respect of the FSC’s position regarding Insurance Premium Financing/Insurance Premium Payments.

It must be noted that the FSC is NOT outlawing Insurance Premium Financing. The FSC is also NOT prohibiting Insurance Companies from accepting monthly payment of premiums by policyholders. The FSC has never and does not propose to restrict companies from receiving premiums monthly, within the context of current requirements.

The FSC has made various proposals relating to improving the market conduct of Insurance Companies and Intermediaries and these proposals were included in an industry consultation paper circulated to Insurance Companies and other key stakeholders. With regards to Insurance Premium Financing there was an initial proposal whereby insurance companies and intermediaries would be restricted from offering premium financing. Entities/companies that are not insurance companies or intermediaries are free to offer premium financing. This was to protect the policyholders from a potential conflict of interest that may arise with insurance entities offering the policies, determining the premium charge and then in turn offering a loan to finance the said premiums. The fact that the insurance company has superior insurance knowledge vis-à-vis the policyholder, it is possible for the insurance company to put the policyholder at a disadvantage.

The FSC’s main concern arose when we received complaints from the public regarding a practice that appeared to infringe on the policyholder’s right to full disclosure. Specifically, there was a provision which allowed the termination of the policyholder’s insurance contract without the policyholder’s knowledge, if the policyholder is in default regarding payment on the premium financing contract. This practice would occur even with the premiums being fully paid up to date through premium financing.

We have since made a commitment to review our position on whether insurance entities may offer premium financing under certain conditions that protect, and are fair to policyholders. That review continues as part of our consultation process.

We regret that we were not able to provide the necessary clarification prior to your airing of this issue. However, we hope that our comments herein will be afforded a suitably prominent place in your future programming for the benefit of the public.

Sincerely,

Everton McFarlane

Executive Director

Leave A Comment