Is Jamaica’s debt rising?

October 16, 2020

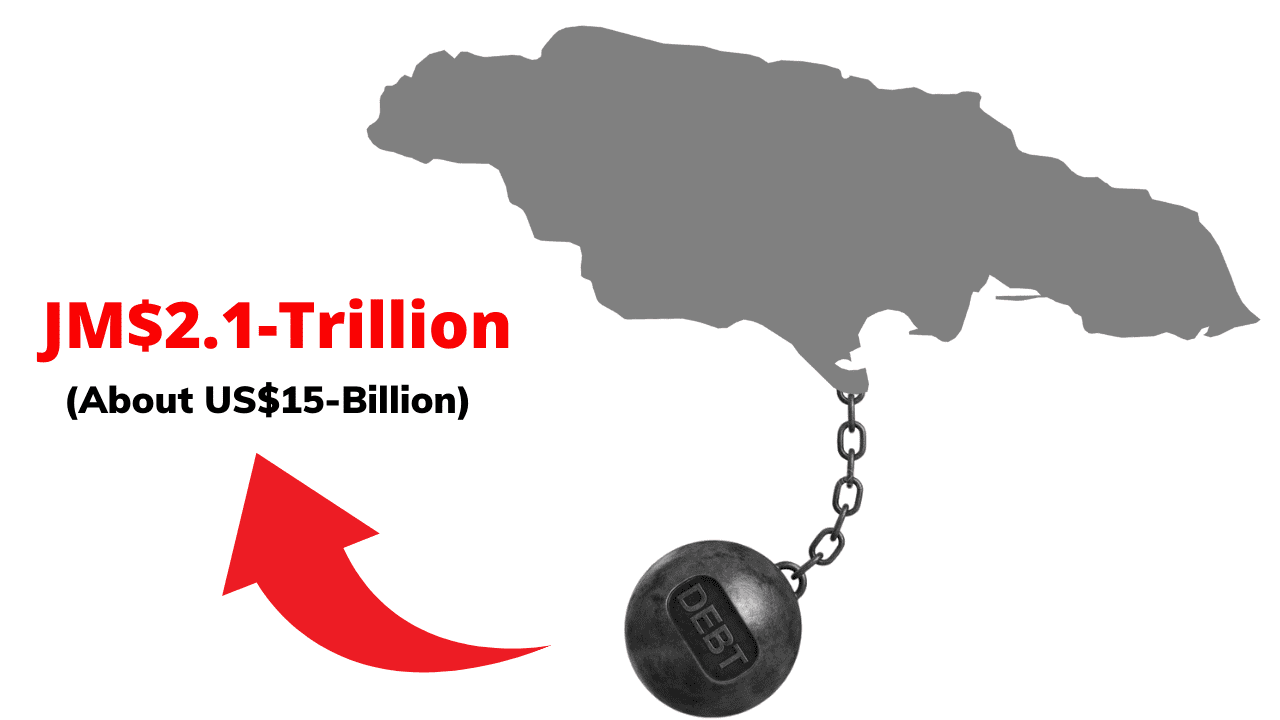

Minister of Finance and the Public Service, Dr. Nigel Clarke expects the value of Jamaica’s debt to remain in the range of $2.1-trillion (about US$15-billion) despite the projected increase for the debt to GDP ratio.

Dr. Clarke told Taking Stock that the country’s debt to GDP ratio will “unavoidably” climb this year on account of the pandemic, going up by at least 10 points to 103%. However, he said the nominal debt can still remain the same because the Administration will spend less on debt servicing as part of the plan to help finance the second supplementary estimates for the 2020/21 financial year.

“The impact really is with the relationship between the size of the debt and the size of the economy,” said Dr. Clarke.

The House of Representatives approved the second supplementary estimates on Tuesday to increase the budget by J$16 billion (US$110 million) to J$854 billion (US$6 billion up from the J$838 billion (US$5.8 billion) approved from the first supplementary estimates. Interestingly, the second revised figure is slightly higher than the original budget of J$853 billion tabled in February.

Dr. Clarke reasoned that the value of the country’s debt stock could slightly change if the Government was to draw down on the money given to the country by the International Monetary Fund through its Rapid Financing Instrument (RFI) or similar funds offered by other multilateral institutions. He added that the fluctuation in the foreign exchange rate could also have minimal effects.

The Government usually pays off its debt with the primary surplus, which happens when it earns more than it spends. However, data from the Economic Programme Oversight Committee (EPOC), showed that the government was spending more than it earned at the end of July, going over budget by J$51 billion (US$353 million), creating a fiscal deficit.

According to EPOC, Government spending was 9% higher due in part to the support given for COVID-19 relief. Under the revised estimates, more support will be given to those hardest hit. To help finance the increased spending, the Administration has slashed the primary surplus target from 3.5% to 3.1% of GDP, to free up J$11 billion (US$ 76 million).

Dr. Clarke said by reducing the primary balance, some of the country’s debt will be funded by “deficit spending”. “The debt obligation is a legal obligation so we don’t have discretion to simply change the amount we spend on debt, that amount is fixed,” he said.

Due to the nature of the pandemic, Jamaica’s fiscal rules have been suspended for the remainder of this fiscal year ending March 31, 2021 to allow the Government to “deal with the situation at hand” such as spending more on health. The timeline to reduce the debt to GDP to 60% was also postponed until 2027/2028. Minister Clarke reasoned that this represents the country adjusting to the new COVID-19 reality.

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment