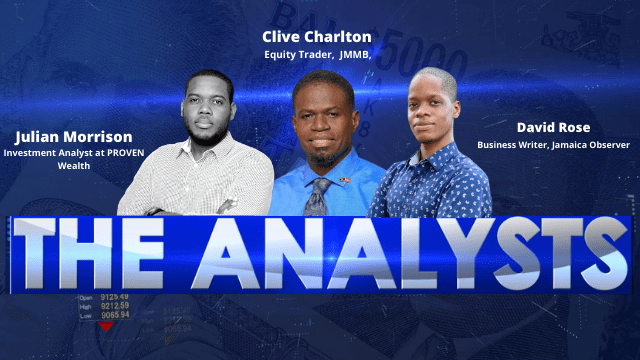

More 2021 Stock Picks from THE ANALYSTS

By: Anthony Morgan

THE Taking Stock ANALYSTS are projecting that market recovery will pick up this year, especially with a number of companies executing successful offers around the latter part of 2020.

Investment Analyst at PROVEN Wealth, Julian Morrison said Barita Investments’ $13.5 billion capital raise in 2020 was the “turning point” for the market after the COVID-19 pandemic forced the decline of the market, causing many issuers and investors to postpone their plans.

“It was proof that investors can still take advantage of the market in a meaningful way,” said Morrison, adding that the Barita Additional Public Offer (APO) shifted the perspective of investors and paved the way for others like Sygnus, Derrimon Trading and PROVEN Investments to put out invitations.

“This year should be even more exciting, we should see more capital raised in 2021,” said Morrison.

The Jamaica Stock Exchange has projected at least 12 new listings on the market this year.

Julian’s picks

In the meantime, Morrison said he expects continued strong performance for companies considered essential during the pandemic in 2021, including Seprod and Fontana Pharmacy.

He said these companies placed extra focus on their business models last year and took advantage of the situation presented by the health crisis.

As for Fonana, he said the company has a competitive advantage based on its strategic store locations and clientele.

The Investment Analyst also expects financial stocks like National Commercial Bank (NCB) to do well this year, highlighting that NCB’s investment in Guardian proved to be an excellent move that he says has, “Really supported them on a segmented basis.”

“I expect more deals in the future from NCB and others. NCB already announced Stratus [Alternative Investments],” added Morrison.

Clive’s picks

Equity Trader at JMMB, Clive Charlton agreed that Barita’s “testing of the market” last year has inspired a renewed energy among investors.

Charlton has also projected that the financial sector will make a turnaround this year. It’s an expectation shared by Senior Wealth Advisor at Ideal Portfolio Service, Orick Angus who made that same declaration on Taking Stock’s 2021 return episode.

According to Charlton the balance sheet of this sector was heavily impacted because they had larger financial assets.

Charton said he also expects Jamaica Money Market Brokers (JMMB) and Derrimon to do well this year. JMMB ended the 2020 down 26% while Derrimon was down 7%.

As for Derrimon, Charlton said its recent acquisition announcement of the wholesale chain in New York bodes well for its outlook.

David’s picks

Business Writer at the Jamaica Observer, David Rose d also has Derrimon among his stocks to watch for 2021. He said DTL as well as Grace Kennedy should continue to grow with the pandemic still forcing many people to stay home while still needing products offered by these companies.

Grace Kennedy in particular is set to have had its best year in 2020 having grown some 35% for the first 9 months of the year, and surpassing its 2019 record.

Rose reasoned that while there was a slow down in GK’s banking portfolio, its acquisition of Key Insurance will help boost its revenues in that sector.

“GK is a great choice to look at,” said Rose.

He’s also eying First Rock Capital Holdings and Mailpac.

“First Rock is doing relatively well and made acquisitions. They should be making headway in real estate projects, there is a great potential upside right there…. Then you have the big player Mailpac. What we saw with those PriceSmart lines was ridiculous. More persons were using them to order their goods or persons were ordering goods flown to Jamaica,” said Rose.

-END-

Leave A Comment