THE ANALYSTS – Game Stop makes a case for short selling in Jamaica

THE ANALYSTS – Game Stop makes a case for short selling in Jamaica

The dramatic rise of the Game Stop stock on the US markets in January has made a compelling case study for allowing the investment strategy of short selling in Jamaica.

“Short selling occurs when an investor borrows a security and sells it on the open market, planning to buy it back later for less money,” according to Investopedia.

“Short sellers bet on, and profit from, a drop in a security’s price. This can be contrasted with long investors who want the price to go up. Short selling has a high risk/reward ratio: It can offer big profits, but losses can mount quickly and infinitely,” the website explains.

The strategy is currently not allowed on the Jamaica Stock Exchange, partly because of system limitations. However, in an interview with Kalilah Reynolds in December 2019 for #MoneyMondaysJa, Managing Director of the JSE, Marlene Street Forrest indicated that the migration to the NASDAQ trading platform would make it possible.

Marlene Street Forrest, Managing Director, Jamaica Stock Exchange

“Next year [2020], because we know that the platform is so built to allow, we’ll be having short selling, we’ll be having margin trading, and we’ll be looking at options,” she said.

However, more than a year later, this has yet to materialize, with local investors still not able to use the strategy.

In the past month, short selling has received a lot of attention due to the sudden rise of Game Stop on the US markets.

The video game retailer’s stock became the central piece in a financial power struggle between a few major hedge funds and a group of amateur stock traders who sell online.

Stakeholders believe the internet activity is the result of frustration that everyday investors are often locked out of big opportunities, such as initial public offerings.

The hedge funds and other professional money managers had been shorting GameStop’s shares, betting that its stock was doomed for failure especially with its physical operations being implicated by the COVID-19 pandemic.

However, retail online traders, including small brokers, pushed the other way, buying shares and stock options, which sent GameStop’s market value soaring in just a few weeks.

According to Investment Research & Sovereign Risk Analyst at JMMB Group, Leovaughni Dillion, there is a perception that if short selling is allowed on the local market, most stocks will lose value.

However, he argued that the Game Stop situation shows that short selling can actually cause a stock to rally (gain value quickly).

Dillon indicated that traders on the JSE are at a disadvantage because they can only express “long positions”.

“Let’s say you have fifty stocks,” he reasoned. “You analyze them and come to a conclusion. You realize that only five of them really are worth buying and twenty of them are highly overvalued. You have no way of really expressing that view. You just have to wait until either the valuation catches up in terms of the company performs and the valuation starts to make sense, or you wait for it to drop, which is usually slow.”

“What short selling would do is that the valuations would instantly more align because persons would take advantage of that part that is highly overpriced and probably do a short sell in order to realize a profit from that, and then drive down the price to values that make sense quickly. Then we readjust and the stock starts trading from there,” added Dillon.

He said short selling would probably help the overall health of the market because it would prevent stocks from becoming overvalued.

“Looking at the developed markets’ way of short selling… there is no evidence that it creates excess lower valuation,” said the analyst. “If you look at the valuation of some companies like Tesla, Amazon, even Apple right now… you’re seeing that valuations are not really cheap in these markets, despite the fact that you have short selling.”

Risky bet

However, this investment strategy does carry heightened risk.

“It’s called ‘short squeeze’ so if the stock is down, you make money; however, if it goes up you’re on the hook to buy back that stock at a higher price, return it to your broker and take a loss,” explained Business Writer at the Jamaica Observer, David Rose.

“Remember there’s a cost to actually shorting the stock, as you have to pay the broker money to actually borrow the stock as well,” he added.

Even with the Game Stop story positioned as the small guy winning against the big guy, Investment Analyst at PROVEN Wealth, Julian Morrison, noted that a number of new investors would have been silently hurt by the Wall Street frenzy.

“There are so many new investors who aren’t so experienced to take advantage of the volatility in the market and are taking a hit under the quiet. When this hullabaloo is all over and the momentum recedes, the price will also recede, so it’s likely that other people will also be hurt in the future too,” said Morrison.

“Those holding the stock are at some fundamental risk because none of this is backed by fundamentals. It’s all momentum, so in other words, the tides can turn quickly and it can turn to extreme losses if not careful,” he added.

-END-

Ask The Analysts

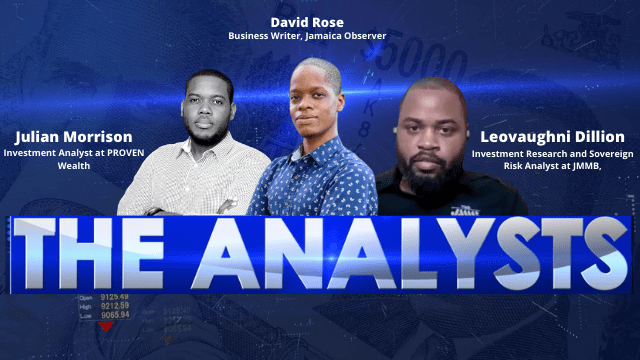

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment