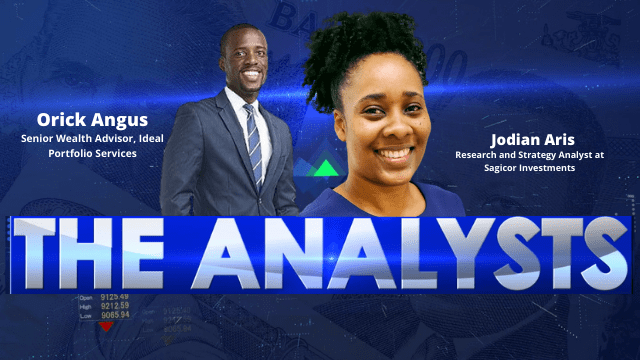

THE ANALYSTS: Less air travel, more charity among reasons for remittance spike in November 2020

By Anthony Morgan

Less air travel and more charity work are being linked to the spike in net remittances in November 2020.

Despite the COVID-19 pandemic causing a fallout in global economies, Jamaicans abroad were able to send home almost 26% more money in November 2020 than they did a year earlier.

According to data from the Bank of Jamaica (BOJ), net remittance inflows increased by US$45 million last November to roughly US$221 million. Overall, Jamaicans abroad sent home US$2.6 billion between January and November last year.

Research and Strategy Analyst at Sagicor Investments, Jodian Aris pointed out that November’s remittance surge came as a result of gross inflows outweighing outflows for the period under review. Gross remittance inflows increased by some 18.7% or US$37.5 million while outflows dropped by 32% or US$7.7 million.

Aris said every month up to November 2020, with the exception of March and April, saw an increase in remittance inflows, a situation she suspects was ironically linked to the travel restrictions imposed across territories as part of efforts to slow the spread of the virus.

“Possibly persons who would visit Jamaica and have funds for family members weren’t able to travel and opted to send money [via remittance companies] and it has been captured in that new way,” said Aris.

She said the increase in philanthropic activity over the period was also a likely contributor to the spike in the figures.

“We’re also seeing an increase of persons wanting to give back generally because of the situation we have with COVID-19. We would have seen quite a bit of alumni giving back to their alma maters in terms of tablets and donations [to assist with virtual learning] so that could have been a part of the spike as well,” reasoned Aris.

Figures up to November showed the USA continuing to be the largest source of net remittance inflows, with Canada, the UK and the Cayman Islands also contributing notable shares. November 2020 figures show the US’s share increasing to just over 68% from the 64% recorded in the same month during 2019.

Meanwhile Aris said the data showed that only February recorded an increase in remittance outflows, with the pandemic kicking up in the ensuing months. The decline here, she said was likely to have been impacted by the new teaching and learning trend, spurred on by the health crisis.

“Typically outflows would go up for students studying abroad so the parents would probably send funds and during the period because of COVID-19, quite a few students came back so there really isn’t much of a need to send funds for them, seeing that they are at home and may still be here but doing classes online,” she reasoned.

Remittances are one of Jamaica’s largest sources of US dollars and contributes significantly to GDP. Those transfers along with tourism earnings, help to keep the local dollar competitive against others like its US counterpart.

-END-

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment