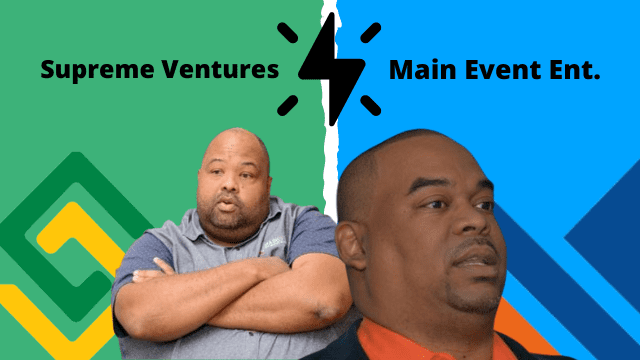

THE ANALYSTS: SVL stake in Main Event a Conflict of Interest?

Eyebrows have been raised over Supreme Ventures recent acquisition of a 10% stake in Main Event Entertainment Group; however, THE ANALYSTS of Taking Stock believe there’s no real cause for concern.

In announcing the acquisition, SVL said the move was aligned with it’s growth and expansion strategy. It added that the acquisition would also enable SVL to better leverage its entertainment brand to serve a wider cross section of customers with products that are aligned to their evolving needs.

However, eyebrows have been raised because Main Event’s Co-owner and Chief Executive Officer (CEO) Solomon Sharpe also Chairs the Board of Directors for SVL’s wholly owned subsidiary Supreme Ventures Racing & Entertainment Limited (SVREL).

Sharp is scheduled to appear as a guest on next week’s episode of Taking Stock with Kalilah Reynolds.

Executive Chairman of the SVL Group, Gary Peart also has connections with Main Event, through one of its controlling shareholders, Mayberry Jamaican Equities Limited (MJE). Peart is the CEO of MJE’s parent company, Mayberry Investments.

Senior Wealth Advisor at Ideal Portfolio Services, Orick Angus

Senior Wealth Advisor at Ideal Portfolio Services, Orick Angus said while the deal can be scrutinized due to both companies sharing upper management personnel, he doesn’t see it affecting operations.

“They would have gone through their due diligence and the legalities behind it… I saw it though and I was thinking about that [conflict of interest] but I think all in all they are ok to do that,” said Angus.

He said that while he was taken by surprise with the announcement, he anticipates that it will play out well in the long term for the Supreme Ventures Group.

“SVL is a very aggressive company so looking into that space is kind of an opportunity for them. There’s no problem in diversifying. We always encourage companies and individuals to do that so why not? I have no objections towards the deal,” he said.

Research and Strategy Analyst at Sagicor Investments, Jodian Aris said the move could be a result of the added competition coming to the lotteries sector which remains the core business for SVL. Two new players, Mahoe Gaming and Goodwill Gaming, were recently approved to enter the market, breaking up SVL’s monopoly.

Aris said while she isn’t for companies diversifying too much from their core, the action becomes a necessity especially if the company anticipates a plateau in growth.

SVL has already branched out to other areas including logistics, back end business services, and microfinancing.

They’ve also just announced a partnership with Main Event in the creation of a production company to gain a foothold in the entertainment space. Both SVL and Main Event will own 50% of the new production company.

Research and Strategy Analyst at Sagicor Investments, Jodian Aris,

“To continue getting growth going forward, they have to look at different avenues whether it be mergers or acquisitions to spur growth, and there is competition now in the betting space,” said Aris.

“It [betting and gaming] may be a market that has been tapped out as a potential avenue for growth and… that could necessitate them branching out or looking to other avenues but I prefer when a company is good at core and they continue to build on core,” she added.

Aris said she doesn’t fear any repercussions from both companies sharing interests, especially as Jamaica’s market environment enables this type of situation from time to time.

“Our market is not necessarily as big as we sometimes imagine. It’s really how it is that a company is going to, within their corporate governance policy, control related party interaction. Because our market isn’t very big, it is likely that you’ll have these sorts of relationships and on the surface there are quite a bit of linkages with other related parties,” she reasoned.

At the end of trading on May 7, 2021, and following news of the partial acquisition by SVL, Main Event’s stock was up 34% on the JSE.

-END-

Ask The Analysts

The Cast David Rose Business Writer, Observer Leovaughni Dillion Investment Research & Sovereign Risk Analyst at JMMB Group

R.A. Williams to list on JSE

The Cast Audley Reid CEO R.A. Williams Distributors Julian Morrison Founder, Wealth Watch JA

Leave A Comment